Wall Street Initiates Trading with Declines in Chip-Equipment and Auto Stocks

On Friday, Wall Street primary indices experienced a lower opening, marked by declines in the shares of Ford, General Motors, and chip-equipment manufacturers. However, optimism stemming from expectations of a potential pause in U.S. interest-rate hikes provided some support to investor sentiment.

READ: New York Businesses Ordered to Require Masks Indoors or Vaccine Proof

Wall Street

At the commencement of the trading session, the Dow Jones Industrial Average displayed a marginal decline of 5.07 points, equivalent to 0.01 percent, bringing the index to 34,902.04. Simultaneously, the S&P 500 opened with a decrease of 7.12 points, or 0.16 percent, settling at 4,497.98. The Nasdaq Composite, too, registered a drop, initiating the session with a decline of 36.85 points, representing 0.26 percent, and reaching 13,889.20.

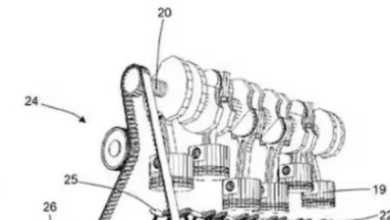

The notable decline in the shares of automotive giants Ford and General Motors, alongside setbacks in chip-equipment manufacturers, contributed to the overall negative market opening.

These factors weighed on the performance of key indices. Despite the challenges faced by specific sectors, the broader market sentiment received a boost from the prevailing optimism surrounding a potential pause in the U.S. Federal Reserve’s interest-rate hikes.

Investors closely monitored developments in interest-rate policies, with anticipation of a more accommodative stance, which contributed to a degree of stability in the market.

As the trading day unfolded, market participants continued to assess various factors influencing stock movements, including corporate earnings, economic indicators, and global geopolitical developments. The interplay of these elements shaped investor decisions throughout the trading session, determining the overall trajectory of the stock market.