Hold Your Horses: Vodacom Group Puts M-Pesa Sale on Ice for Now

Hold Your Horses: Vodacom Group Puts M-Pesa Sale on Ice for Now In the wild world of telecoms, where everyone seems to be selling bits of this and chunks of that, Vodacom Group is doing its best impression of a wise owl, sitting back and saying, “Not yet, my friends, not yet.”

You see, Airtel Africa and MTN Group have been playing financial chess, selling minority stakes in their mobile money ventures. Airtel Africa made the first move in 2021, while MTN Group decided to join the game,

announcing its intentions to sell a piece of its mobile money arm to the financial heavyweight, Mastercard. But Vodacom, with its 35 percent stake in Safaricom, the parent company of the behemoth M-Pesa, is taking a different approach. They’re not ready to dive into the sell-a-thon just yet.

Vodacom’s CEO: We’re Growing, Not Selling!

Shameel Joosub, the CEO of Vodacom, gave a nod to the M-Pesa empire’s potential but made it clear they are on team growth for now. “We’re still doubling down to make sure that we can grow the use cases, the one app strategy, the mini app strategy,

M-Pesa for kids, the investments, the international money transfer and so on,” Joosub said during a recent conference call with analysts. He humorously declared, “We haven’t decided yet to pursue a potential sale,” as if Vodacom is keeping the M-Pesa auctioneers on hold music.

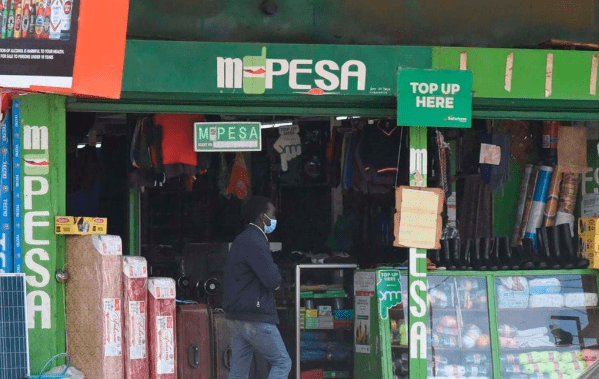

M-Pesa: Africa’s Money Maestro

M-Pesa, the grandmaster of mobile money platforms in Africa, is Vodacom’s golden goose. With its massive customer base and transaction value, it’s like having a diamond-studded ostrich in your backyard – you don’t want to part with it too soon.

Vodafone, M-Pesa’s proud parent, boasts that its mobile platforms, including Safaricom, juggled a jaw-dropping $370.6 billion of transaction value over the 12 months to September. That’s a lot of financial acrobatics happening under the African sun.

Vodacom’s M-Pesa Game Plan: Not All Eggs in One Basket

Vodacom is strategically packaging M-Pesa businesses in multiple countries independently, with the exception of Kenya. Mr. Joosub explained, “In terms of the M-Pesa sale process, what we have done successfully is separated the different companies into different entities except for Kenya.” It’s like setting up a fancy flea market, and Kenya gets the VIP tent.

Future Fortune Telling: M-Pesa Revenue Extravaganza

Despite the playful banter, Vodacom is not oblivious to the potential cash shower. Mr. Joosub confidently projected that the absolute M-Pesa revenue, including Kenya, is expected to hit between $1.6 billion and $1.7 billion in the current financial year ending March 2024. Now that’s what we call making it rain – in a digital currency kind of way.

So, as Vodacom continues to nurture its M-Pesa empire, the telecom drama unfolds. Will they eventually join the sell-off party, or will M-Pesa keep reigning as the African money maestro? Only time will tell, but for now, Vodacom is sipping its virtual tea, watching the financial circus from a comfortable distance.